Income Tax Slab For Senior Citizen & Super Senior Citizen FY 2025-26 (AY 2026-27)

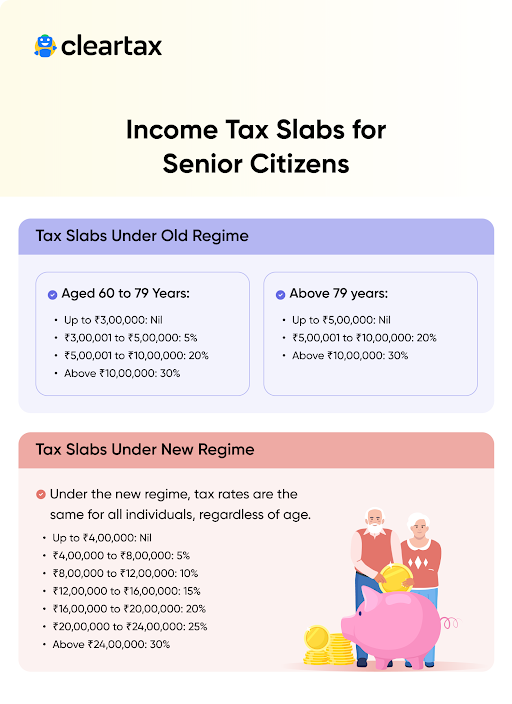

The Income Tax Act 1961, offers a higher basic exemption limit to senior citizens under the Old Tax Regime. While Senior Citizens between 60 to 80 years enjoy a basic exemption limit of Rs. 3 lakhs, super senior citizens above 80 years of age enjoy Rs. 5 lakhs basic exemption limit.

However, the New Tax Regime does not offer any such kind of higher basic exemption limit for Senior and Super Senior Citizens.

Meaning of Senior Citizen and Super Senior Citizen

- Income Tax Act has categorized resident individuals into 3 parts-

- Individuals whose age is up to 60 years

- Senior citizens - Individuals aged between 60 to 80 years

- Super senior citizens - Individuals over 80 years of age

- Under the Income Tax Act, senior citizens are resident individuals aged between 60 to 80 years, while super senior citizens are resident individuals aged above 80 years.

- Resident senior and super senior citizens are provided with concessional tax rates under the old regime. No concessional tax rates are available under the new tax regime for them.

- They have an option to pay tax as per the old or the new tax regime.

- Non-resident senior citizens are not eligible for the concessional tax slabs, the normal provisions of income tax are applicable to them.

Age Eligibility

- Age Attainment Rule: For income tax purposes, a person is considered to have attained a particular age on the day preceding their birthday.

- Application: This rule determines eligibility for senior/super senior citizen tax benefits.

- Age Determination Criteria

- A resident individual is considered a senior citizen if they attain 60 during the financial year.

- If a person’s 60th birthday falls on 1st April 2026, they are deemed to have attained the age of 60 on 31st March 2026.

- Therefore, they are eligible for the higher basic exemption limit of ₹3 lakh under the old tax regime.

Similarly, the age limit of 80 years is also calculated for super senior citizens.

Income Tax Slab for Senior Citizen

As per the old tax regime, the income tax slabs and respective rates for senior citizens above 60 years for FY 2025-26 (AY 2026-27) are as follows-

| Income Slabs | Income Tax Rates |

| Up to Rs. 3 lakh | NIL |

| Rs. 3 lakh - Rs. 5 lakh | 5% |

| Rs. 5 lakh - Rs. 10 lakh | 20% |

| Above Rs. 10 lakh | 30% |

Income Tax Slab for Super Senior Citizen

Super senior citizens above 80 years of age can also avail the benefit of the old and new tax regimes as they have the choice to opt between the two, whichever is more beneficial.

As per the old tax regime, the income tax slabs for super senior citizens above 80 years for FY 2025-26 (AY 2026-27) are as follows:

| Income Slabs | Income Tax Rates |

| Up to Rs. 5 lakh | NIL |

| Rs. 5 lakh - Rs. 10 lakh | 20% |

| Above Rs. 10 lakh | 30% |

Income Tax Slab Rate as Per New Tax Regime for Senior and Super Senior Citizen

The new tax regime applies the same tax slabs to all, including senior and super senior citizens. However, taxpayers have to forgo many deductions and exemptions available to them.

The revised tax slabs under the new regime for FY 2025-26 (AY 2026-27) as amended in Budget 2025 are as follows:

| Income Tax Slabs | Income Tax Rates |

| Up to Rs. 4 lakh | NIL |

| Rs. 4 lakh - Rs.8 lakh | 5% |

| Rs. 8 lakh - Rs.12 lakh | 10% |

| Rs.12 lakh - Rs.16 lakh | 15% |

| Rs.16 lakh - Rs. 20 lakh | 20% |

| Rs. 20 lakh - Rs. 24 lakh | 25% |

| Above Rs. 24 lakh | 30% |

A pictorial summary of the above information is presented below;

Cess and Surcharge

Cess

The above calculated tax for senior and super senior citizens shall be increased by Health and Education Cess @ 4% for both the regimes.

Surcharge

Additionally, surcharge is applicable on the basis of total income as follows:

The surcharge is applicable on the basis of total income as follows:

| Total Income | Surcharge Rate |

| > Rs. 50 Lakhs | 10% |

| > Rs. 1 crore | 15% |

| > Rs. 2 crore | 25% |

| > Rs. 5 crore | 37% |

Note: The highest surcharge applicable under the new regime is 25%.

Sources of Income for Senior and Super Senior Citizens

Senior and super senior citizens usually earn income from the following sources :

- Pension

- Interest on savings accounts or fixed deposit schemes

- Rental Income from renting out a house property

- Income from Capital Gains

- Senior citizen saving schemes

- Reverse mortgage schemes

- Post office deposit schemes which also pay interest, and many others

When are Senior Citizens not Required to File Income Tax Return?

Senior citizens are not required to file income tax returns subject to satisfaction of all the below conditions:

- Their age is 75 years or more

- Total income consists of only pension and interest income. Interest income can be from any account maintained with the same bank in which they receive pension.

- They have submitted a declaration to the bank

- TDS is deducted by such bank under Section 194P

Also, there are more tax benefits provided to the senior citizens namely increased medical insurance deduction, exemption on capital gains on reverse mortgage scheme, etc.

Conclusion

Filing an income tax return is an important way to declare your total income and contribute to the nation's development. It helps the government fund infrastructure and essential services such as healthcare and defense. Meeting all tax obligations before the due date is crucial to avoid penalties and legal consequences. Additionally, filing an income tax return holds significant legal value as it is an official record with the government.